In a landmark period for institutional digital asset infrastructure, the crypto world witnessed two significant developments that signal a maturing marketplace: the Canton Network’s partnership with iBTC to enable the use of bitcoin as collateral with privacy-preserving features, and Ripple’s acquisition of global multi-asset prime broker Hidden Road. Together, these moves point to a pivotal evolution in the convergence of traditional finance (TradFi) and decentralized finance (DeFi).

Canton Network and iBTC: Privacy-Preserving Bitcoin Collateral

On March 24, 2025, the Canton Network announced its integration with iBTC, a bridgeless wrapped Bitcoin protocol, to allow institutions to post bitcoin as collateral while maintaining transactional privacy. This initiative positions Canton as a leader in institutional blockchain infrastructure, enabling secure, private, and interoperable on-chain transactions.

Canton, described as the first public chain purpose-built for institutional assets, was initially developed using technology from Digital Asset. Since then, it has transitioned into an open-sourced and decentralized platform. The network boasts robust privacy controls and interoperability mechanisms, making it highly suitable for regulated entities seeking to utilize digital assets in a compliant yet flexible manner.

Eric Saraniecki, head of network strategy at Canton, emphasized the significance of integrating bitcoin into the ecosystem. “There would be a big hole in the Canton Network if we didn’t have bitcoin in the ecosystem,” Saraniecki stated, noting that integrating iBTC has been a strategic priority for the network. The collaboration aims to empower institutional participants to use bitcoin effectively across various financial applications.

Wrapped crypto tokens like iBTC are crucial for cross-chain interoperability, as they replicate the value of native tokens from one blockchain to another. What makes iBTC unique is its bridgeless architecture, enhancing security while eliminating traditional cross-chain risks.

Derivatives Market and Institutional Use Cases

Saraniecki further highlighted the dominance of bitcoin in the digital derivatives space. Contrary to the broader label of “crypto derivatives,” he asserted that it remains overwhelmingly a Bitcoin-centric market. This assertion aligns with Canton’s recent pilot project in January 2025 in collaboration with Digital Asset and Singapore-based QCP Capital, a digital asset derivatives market maker. The initiative focused on on-chain collateral and margin solutions for bilateral derivatives transactions, with approximately 90% of the trades using bitcoin as collateral.

Through its partnership with iBTC, Canton now enables institutions to post wrapped bitcoin as either initial or variation margin. This allows for highly efficient and private margining operations. Margin cycles will occur every two to four hours, facilitating continuous bitcoin flow in response to market volatility.

Privacy remains central to Canton’s value proposition. The network’s privacy configurations ensure that transactional data and flows are visible only to the relevant counterparties, preserving confidentiality while meeting regulatory standards. This architecture also serves as a bridge between DeFi and TradFi, allowing financial institutions to use tokenized bitcoin on a public blockchain under controlled privacy conditions.

The rollout is initially limited to a select group of institutional participants. However, Canton plans to scale its reach to 10 to 20 firms, facilitating daily trading volumes between $20 million and $50 million. iBTC will also operate as a Canton Network Validator, earning mining rewards and other ecosystem incentives.

According to Saraniecki, there is significant institutional interest in utilizing bitcoin within Canton, particularly due to its privacy features. “People are already talking to us about very interesting bitcoin structured products because it can really transform capital formation for bitcoin-denominated businesses,” he said.

Expanding the Institutional Ecosystem

Canton’s broader ambition is to provide comprehensive utility for crypto collateral across a multitude of financial applications. This includes connections to triparty agents, settlement facilities, and prominent crypto derivatives exchanges and custodians. By offering privacy across these venues, Canton hopes to standardize bitcoin’s use across regulated and decentralized finance landscapes alike.

This aligns with the findings of Crisil Coalition Greenwich’s recent report, Digital Asset Trading 2025: A Market in Transition, which predicts explosive growth in crypto derivatives, particularly options. The study noted that 65% of institutional crypto traders are already engaging with derivatives markets, including futures, options, and perpetual futures. The rise of ETFs, particularly those tied to bitcoin, is expected to accelerate this trend.

Senior analyst David Easthope of Crisil Coalition Greenwich underscored the shift toward a more mature market structure, highlighting the emergence of institutional-grade infrastructure. “It’s a good time to be a regulated derivatives market for digital assets,” said Easthope.

Ripple’s Acquisition of Hidden Road: Bridging Prime Brokerage Gaps

In another milestone for the institutionalization of digital assets, Ripple announced on April 8, 2025, its acquisition of Hidden Road, a premier global prime broker, for $1.25 billion. This acquisition makes Ripple the first crypto-native company to own and operate a global, multi-asset prime broker, significantly expanding its service offerings for financial institutions.

Hidden Road provides institutional clients with services across foreign exchange, digital assets, derivatives, swaps, and fixed income. With over 300 institutional clients and annual clearing volumes of $3 trillion, the acquisition strategically positions Ripple to service a rapidly growing pipeline of institutional demand.

As part of the integration, Hidden Road will adopt Ripple’s US dollar stablecoin, RLUSD, as collateral across its suite of prime brokerage products. This marks a first in the digital asset space, as RLUSD will enable efficient cross-margining between traditional and crypto markets.

Marc Asch, founder and CEO of Hidden Road, welcomed the deal: “Together with Ripple, we’re bringing the same level of trust and reliability that institutional clients are accustomed to in traditional markets — designed and optimized for a digital world.”

Ripple CEO Brad Garlinghouse echoed this sentiment, describing the acquisition as a “once-in-a-lifetime opportunity” to connect crypto with the most established traditional markets.

Institutional Maturity and the Rise of Full-Stack Infrastructure

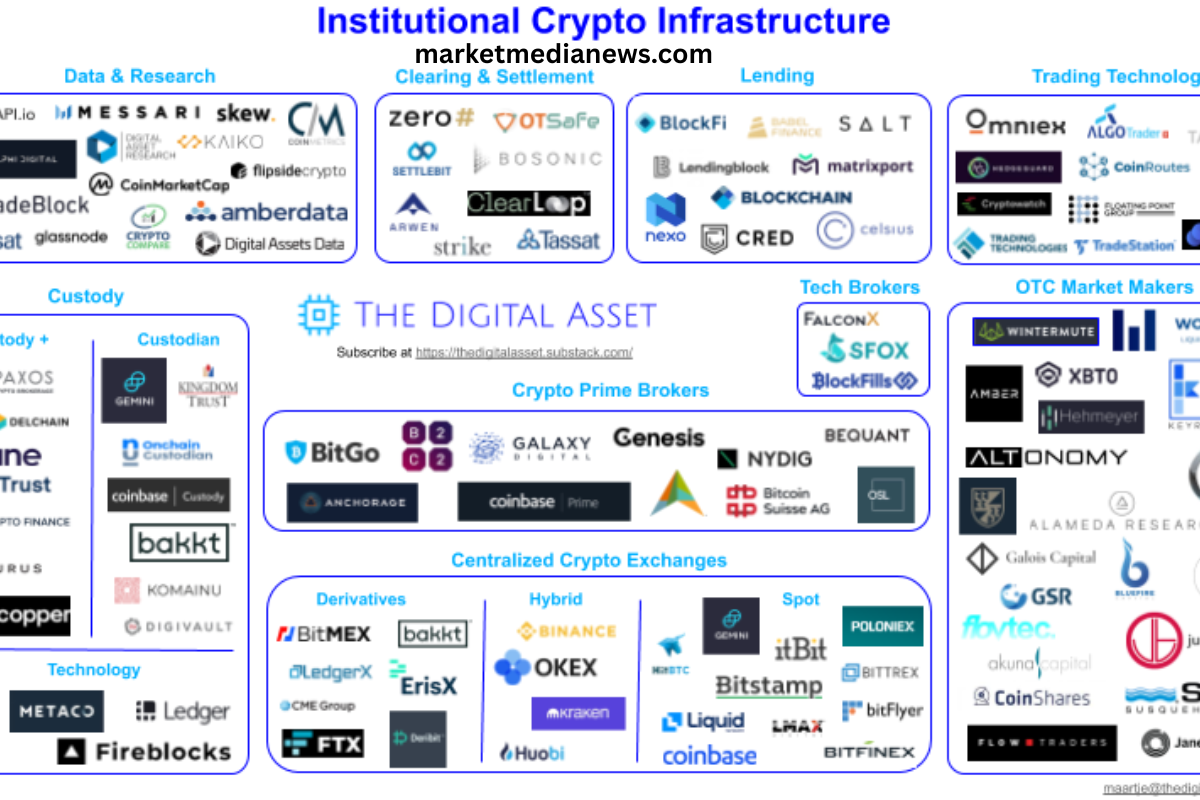

The moves by Canton and Ripple come amid a broader industry shift toward comprehensive, full-stack infrastructure for institutional crypto traders. Firms such as Bullish, LMAX Digital, Zodia, EDX Markets, and Crossover are enhancing trading venues, while BitGo, Galaxy Digital, FalconX, and Hidden Road are developing advanced prime brokerage services. Custodians like Etana, Anchorage, BitGo, and Copper are also building institutional services to support custody, settlement, and collateral management.

The combination of enhanced trading venues, settlement systems, and custody solutions marks the transition from an experimental phase in crypto to a regulated, mature financial ecosystem. These changes are not only being driven by market infrastructure providers but also by rising institutional demand for secure, privacy-centric, and efficient solutions.

Easthope noted that the growth of full-stack prime brokerage services will offer institutional traders a more integrated and coordinated experience across the trading lifecycle. From order execution to post-trade settlement and staking, the goal is to mirror the reliability and sophistication of traditional financial systems.

Breaking Down Barriers Between TradFi and DeFi

Perhaps the most important takeaway from recent developments is the blurring of lines between TradFi and DeFi. Canton’s privacy-preserving, interoperable blockchain allows traditional institutions to engage with DeFi markets while adhering to their risk and compliance mandates. Simultaneously, Ripple’s acquisition of a major prime broker provides crypto firms with the tools and credibility to operate in mainstream financial environments.

Saraniecki challenged the notion of a divide between the two worlds: “The distinction between crypto-native and TradFi is a bit of a false dichotomy. When Canton is super-successful, we will have been the ledger that knocked down this artificial barrier.”

With the market evolving toward this unified future, institutional involvement is no longer speculative. It is now a strategic necessity. The convergence of technology, privacy, regulation, and liquidity is forging a new paradigm—one where the boundaries between traditional and digital finance no longer exist.

As crypto derivatives markets expand and institutional infrastructure matures, the momentum is clear: digital assets are no longer an outlier—they are becoming foundational to the future of finance.

Frequently Asked Questions

What is the Canton Network?

The Canton Network is a privacy-preserving, interoperable public blockchain tailored for institutional financial applications, originally developed using technology from Digital Asset.

What is iBTC?

iBTC is a bridgeless, wrapped Bitcoin solution that enables Bitcoin to be used across decentralized applications while maintaining high security and liquidity.

Why is iBTC integration significant?

It allows Bitcoin to be used as collateral with privacy on Canton, enabling efficient, on-chain margining and structured financial products.

What is Ripple’s acquisition of Hidden Road about?

Ripple acquired Hidden Road, a global multi-asset prime broker, to become the first crypto firm operating a full-scale, institutional-grade brokerage.

What is RLUSD?

RLUSD is Ripple’s US dollar-backed stablecoin, now used as collateral within Hidden Road’s prime brokerage products for efficient cross-margining.

How does this affect traditional finance (TradFi)?

These developments allow TradFi institutions to access DeFi with privacy and compliance, bridging the gap between two financial worlds.

What are the implications for crypto derivatives?

With 90% of trades using Bitcoin and a growing market for options, these moves support institutional-grade derivatives infrastructure with privacy and scalability.

Who benefits from these changes?

Institutional investors, asset managers, and trading firms looking for secure, efficient, and compliant access to crypto markets benefit the most.

Conclusion

The convergence of institutional finance and crypto is accelerating, led by innovations like Canton Network’s iBTC integration and Ripple’s acquisition of Hidden Road. These developments highlight the growing demand for privacy, efficiency, and regulatory compliance in digital asset markets. As infrastructure evolves, the lines between TradFi and DeFi blur, paving the way for a more unified, mature financial ecosystem where digital assets become core to institutional strategies.