Since relocating its headquarters to Miami nearly three years ago, Citadel Securities has become more than just a newcomer to South Florida—it has emerged as a transformative force within the city’s evolving financial ecosystem. The firm’s impact is seen not only in the expanding opportunities it offers professionals but also in how it is helping redefine the city’s identity as a thriving financial hub.

Among those driving this transformation is Rodrigo Parada Valencia, the Chief Operating Officer (COO) of US Options Market Making at Citadel Securities. Parada Valencia’s journey reflects both personal and professional growth and highlights the broader shifts taking place in Miami’s finance scene.

A Decade in the Magic City

Although Citadel Securities has only recently planted its flag in Miami, Parada Valencia has called the city home for over a decade. His experience provides a unique lens into Miami’s metamorphosis from a laid-back coastal city into a magnet for top-tier talent across finance, technology, and healthcare.

“When I first moved to the city, it almost felt like a small town compared to places like New York and Chicago,” he shared. “Now, there are some very compelling career opportunities and no shortage of enriching ways to spend your time outside of the office—whether you’re into the arts, outdoor activities, or the incredible restaurant scene.”

His perspective aligns with a growing sentiment that Miami is not only a great place to live but also a competitive environment for ambitious professionals. The city’s unique lifestyle, coupled with its increasing economic diversification, is turning it into a destination for those seeking more than just sun and sand.

Citadel Securities’ Commitment to Miami

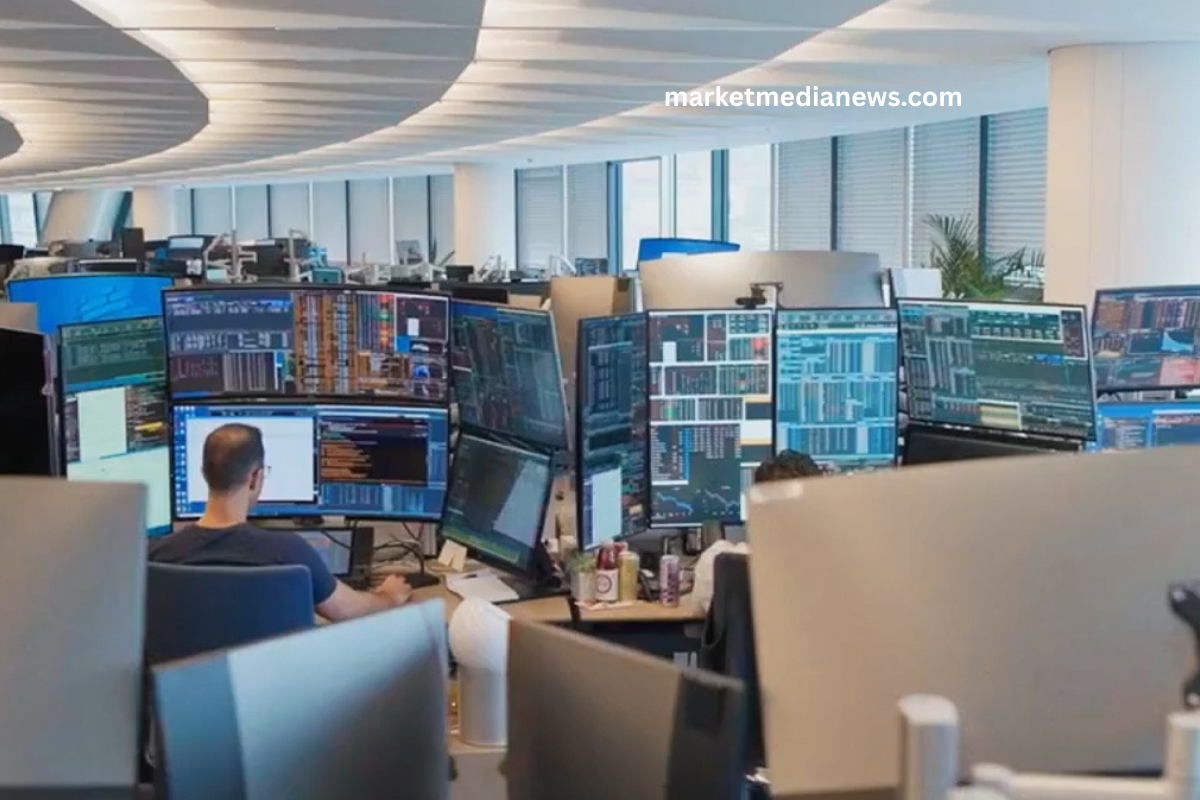

Citadel Securities’ move to Miami was more than just a change of scenery—it was a strategic decision to tap into a rapidly developing talent market and contribute to its momentum. The firm’s leadership, including Founder Ken Griffin and CEO Peng Zhao, are based in the city, reinforcing its importance as a center of operations and innovation.

“Having senior leaders based here helps foster a culture of collaboration and continuous learning,” said Parada Valencia. “It creates a dynamic environment where career growth is not just possible—it’s actively encouraged.”

Employees at the firm have found that Miami offers more than just professional opportunities. Many cite an enhanced quality of life since relocating, with more time spent outdoors and greater focus on health and wellness. This holistic balance is something Parada Valencia believes makes Citadel Securities’ Miami office particularly special.

Building a Career Through Innovation

Parada Valencia’s own career path is emblematic of Citadel Securities’ appeal. With a background in corporate strategy, wealth management, and consulting, he’s held positions at LatAm Airlines, JPMorgan, and McKinsey. His decision to join Citadel Securities was driven by the firm’s entrepreneurial culture and ambitious growth trajectory.

“The opportunity to join Citadel Securities was too good to pass up,” he explained. “The firm’s track record of success, combined with its innovative, growth-oriented mindset, made it incredibly appealing.”

As COO of US Options Market Making, Parada Valencia is responsible for shaping the long-term strategy of one of the firm’s most complex business units. “My focus is on helping to develop and drive the top-down strategy for our options business in the U.S.,” he noted. “I serve as a thought partner to business leaders, ensuring that we’re making the right strategic decisions.”

Driving Market Innovation: OCC Self-Clearing

One of his most impactful recent initiatives has been launching OCC self-clearing capabilities. In a market where only one provider had dominated, Citadel Securities’ move to internalize clearing was a game-changer.

“This significantly reduces concentration risk in the market,” Parada Valencia explained. “Creating this capability in-house allows us to better control risk and improve operational efficiency.”

The Skills Behind the Strategy

Operating in such a fast-paced environment demands a specific set of skills. Parada Valencia credits his success to structured thinking, effective communication, and ruthless prioritization.

“There’s never a shortage of critical projects to drive, but time is always limited,” he said. “That’s why it’s essential to be hyper-focused and organized.”

A crucial aspect of his role is translating complex problems into actionable insights. “Many of the people I work with are domain experts, so I need to ensure I understand the issue at hand deeply and can frame it within our broader business objectives.”

Adapting to a Rapidly Changing Market

The options trading landscape is evolving rapidly. Recent records have been shattered, with options contracts reaching all-time highs. This isn’t just a U.S. trend—global markets like India are seeing options volumes surpass equity trading.

“In India, options are now the most traded asset class, and we’re watching emerging markets closely for similar developments,” Parada Valencia said.

In the U.S., the market is becoming more fragmented with the launch of new options exchanges. “Two new exchanges launched last year, and we expect more to follow,” he added.

Citadel Securities has designed its systems to remain agile amid these shifts. “We’ve built our platform to scale rapidly. We’re able to handle multiples of the highest historical trading volumes without being slowed down by bureaucracy.”

Talent and Risk: The Foundations of Growth

Attracting and retaining top talent is a cornerstone of the firm’s strategy. “We have incredible opportunities for growth, but our talent bar is extremely high,” Parada Valencia emphasized.

Another core focus is risk management. “Balancing profitability with responsible risk-taking is key. We’re meticulous about setting and adhering to the right risk limits.”

Collaboration is also essential. At Citadel Securities, business, technology, and research teams work in lockstep to tackle the firm’s most pressing challenges.

“Being on the COO team puts you at the heart of the most complex problems we face,” he said. “Our clients are always at the center of what we do, and that unites everyone across the firm.”

Shaping the Future of Finance in Miami and Beyond

Looking ahead, Parada Valencia is optimistic about Citadel Securities’ continued influence—not just in Miami, but globally.

“As options volumes continue to grow in the U.S., the role of market makers becomes even more critical,” he said. “We’re leveraging technology to improve trading efficiency, reduce costs, and make markets more accessible.”

Citadel Securities’ decision to establish its headquarters in Miami is already bearing fruit, not only for the firm but for the broader community. The company is actively engaged in local initiatives and nonprofit organizations, underscoring its long-term commitment to the region.

“I think my colleagues and I truly feel like we’re part of building something,” Parada Valencia concluded. “Whether it’s the future of our office, our careers, or this city—we’re making a lasting impact.”

With leaders like Parada Valencia at the helm, and a firm-wide culture that embraces innovation, Citadel Securities is not just shaping markets—it’s shaping the future of Miami itself.

Frequently Asked Question

Why did Citadel Securities move its headquarters to Miami?

Citadel Securities relocated to Miami to capitalize on the city’s growing talent pool, business-friendly environment, and unique lifestyle advantages. The move aligns with the firm’s vision of scaling innovation and driving long-term growth in a dynamic setting.

What makes Miami attractive to finance professionals?

Miami offers a combination of professional opportunity and lifestyle benefits. With an influx of top-tier talent and firms across finance, tech, and healthcare, the city now provides a vibrant ecosystem for career growth, collaboration, and personal well-being.

What is Rodrigo Parada Valencia’s role at Citadel Securities?

As COO of US Options Market Making, Parada Valencia oversees strategic planning and execution for one of the firm’s core business areas. He helps define top-down strategies, supports decision-making, and leads high-impact initiatives such as OCC self-clearing.

What is OCC self-clearing and why is it important?

OCC self-clearing allows Citadel Securities to manage its own clearing process for options trades. This reduces reliance on external providers, mitigates concentration risk, and enhances operational control and efficiency.

How is Citadel Securities influencing the broader financial market?

Through advanced technology, strategic risk management, and rapid adaptability, Citadel Securities improves market efficiency and access. The firm plays a key role in shaping the future of options trading globally, particularly as volumes hit historic highs.

What kind of talent is Citadel Securities looking for?

The firm seeks individuals with exceptional analytical, strategic, and collaborative skills. While opportunities are vast, the talent bar is intentionally high to maintain excellence in execution and innovation.

How is Citadel Securities involved in the Miami community?

Employees, including senior leaders, are actively involved in local nonprofits and community initiatives. The firm emphasizes long-term engagement with the Miami area beyond business goals.

Conclusion

Citadel Securities’ expansion into Miami represents more than a geographical shift—it marks a significant evolution in the city’s rise as a global financial center. By embedding its entrepreneurial culture, fostering high-impact careers, and investing in both people and technology, the firm is playing a pivotal role in reshaping the economic landscape of South Florida.

With leaders like Rodrigo Parada Valencia at the helm, and a culture rooted in innovation, Citadel Securities is not only influencing the future of options trading but also contributing to a new chapter in Miami’s identity—one where lifestyle and leadership converge to create something truly exceptional.